Self-Storage Delivers Record Performance; Investor Confidence Driving Competition for Assets

Self-storage sector outperforming.

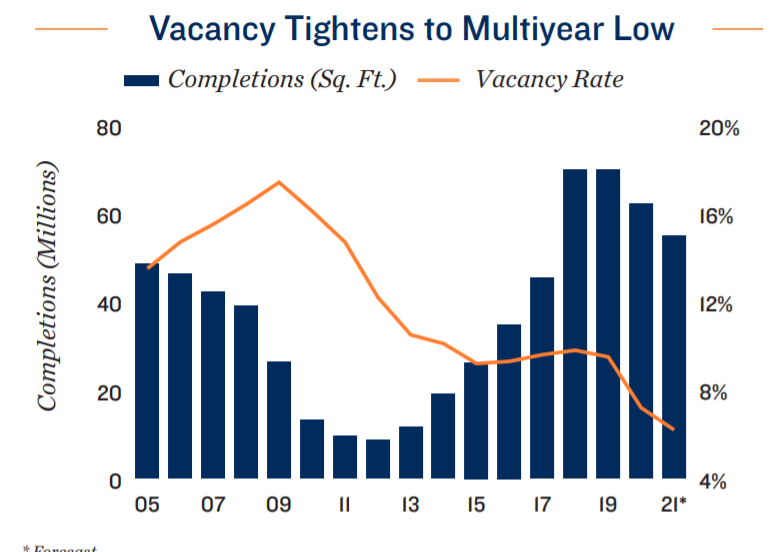

Although not exempt to the challenges posed by the health crisis, self-storage properties have demonstrated remarkable resilience over the past 18 months. Prior to 2020 the sector was contending with the detrimental impact of record construction activity on rents. The swift adoption of remote learning and working practices, as well as migration to less dense areas, created new needs for storage units. This jump in demand has lowered the national vacancy rate to a multidecade low of 5.5 percent in June and revived rent growth across the country. The average asking rent for a standard 10-foot by 10-foot unit has climbed from a trough of $1.13 per square foot in the second quarter of 2020 to $1.24 in June of this year, a value not seen since mid-2016.

Demand drivers transitioning.

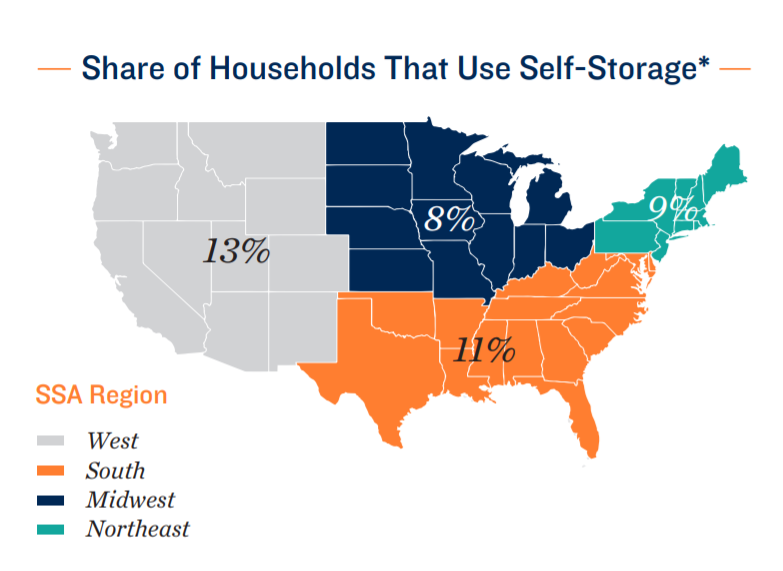

While COVID-19 infections are rising again, in most cases businesses and schools are still opening, leveraging vaccinations to keep individuals safe. College students who had stored belongings when campuses closed will soon retrieve them while some home offices may transform back into spare rooms. At the same time, other motivators for self-storage use are improving. Falling unemployment is fostering both household formation and consumer spending, factors that ultimately encourage self-storage use. The main contributor is coming from migration, however, as moving is the second most common reason to rent a storage unit. The recent suburban relocation trend, while accelerated by the health crisis, is being driven by demographics. Millennials are aging and growing their households, which is shifting lifestyle preferences toward larger dwellings most common in the suburbs. As demand shifts from pandemic-related short-term factors to longer, more stable demographic trends, the pace by which operations improve may moderate.

Investors capturing benefits of record performance.

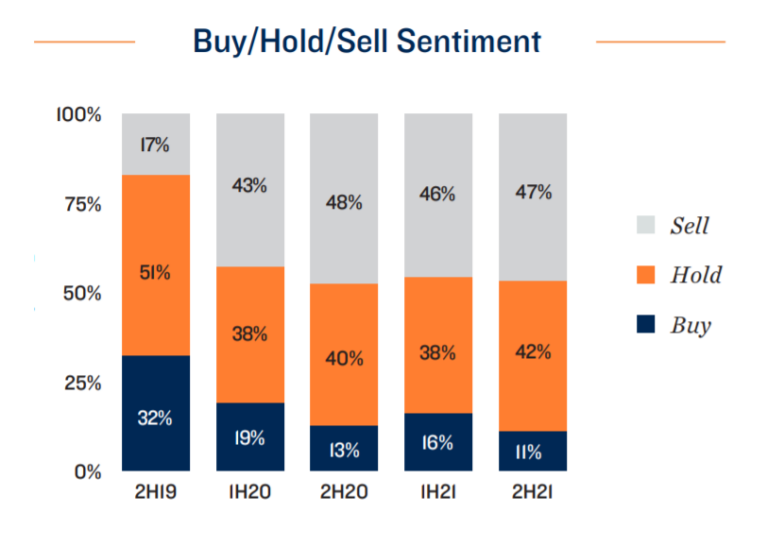

A survey conducted among self-storage investors in early August reflects the high level of confidence exuded among self-storage investors. About 42 percent of owners view this upcoming year as an ideal time to hold onto their properties, capturing the benefits of historically low vacancy and renewed rent growth on cash flows. Sale prices are also appreciating. Self-storage sale prices are up more than 30 percent over the past five years, and more than three-quarters of survey respondents expect them to increase further this year. The consensus was for a growth rate of about 6 percent, which would be slightly above the 4 percent pace set in 2020. The rising prices serve as an additional motivator for investors interested in changing their current holdings. The competition for these listings remains high, driven by strong property performance and current financial market trends.

Low interest rates, positive fundamentals draw new buyers.

More than 80 percent of investors anticipate rising interest rates over the next 12 months and buyers may accelerate their acquisition plans accordingly.

Similar motivations may be influencing some existing owners seeking to make portfolio adjustments. The strong performance of the property type is also bringing in outside parties to the self-storage sector. Survey results reflect this. The sentiment to buy self storage is slightly higher among general commercial real estate investors over current self-storage owners. These factors will continue to support a competitive bidding environment that in turn reinforces the upward trajectory of sales prices. Cap rates are compressing as a result. This may prompt a search for yield in more secondary and tertiary markets, a trend that will be shared among other property types in the quarters ahead.

Demographic Factors Offset Development Pressure

Influence of migration trends evident in metro-level performance.

Over the past year ended in June, the markets that recorded the steepest drops in vacancy were those that also welcomed numerous new residents. The Southeast Florida region, which encompasses Miami-Dade, Fort Lauderdale and West Palm Beach, is the most apparent example. Vacancy in the region fell

440 basis points over the past four quarters to 2.9 percent. The central Florida markets of Tampa-St. Petersburg and Orlando also recorded contractions

of over 400 basis points. Properties in those areas are benefiting from the state's comparatively early economic reopening, which combined with Florida's warm climate and lower living costs to attract households. Similar dynamics are also at play in Texas. Certain region-specific migration patterns are also influencing self-storage use. San Diego posted the lowest vacancy rate of any major market in the second quarter at 2.1 percent. Residential demand in the metro's suburbs has been growing, a reflection of households moving from both the urban core and other California cities for the lower density and costs of living. Similar behavior is driving storage demand in the Inland Empire, where vacancy was 2.5 percent.

Sector better aligned for upcoming supply.

The rapid gains in occupancy and rents recorded over the past year position many markets favorably for projects under construction. While completions for 2021 will fall below the 60 million-square-foot mark for the first time in three years, national inventory will still expand by an above-average 3 percent. The impact to fundamentals will be partially offset by the composition of the development pipeline. Several of the metros where inventories are slated to grow the most in 2021 have trailed in construction in recent years, such as New York City, Sacramento and Las Vegas, or are recording robust population growth, including Phoenix and Southeast Florida. The end to most lockdown conditions should also help newly built facilities more rapidly lease units, an early health crisis dilemma that pushed more customers to rent units online. The ability to lease storage space both physically and digitally should help reduce the downward pressure on asking rates at new facilities, preserving overall rent growth even if health conditions worsen.