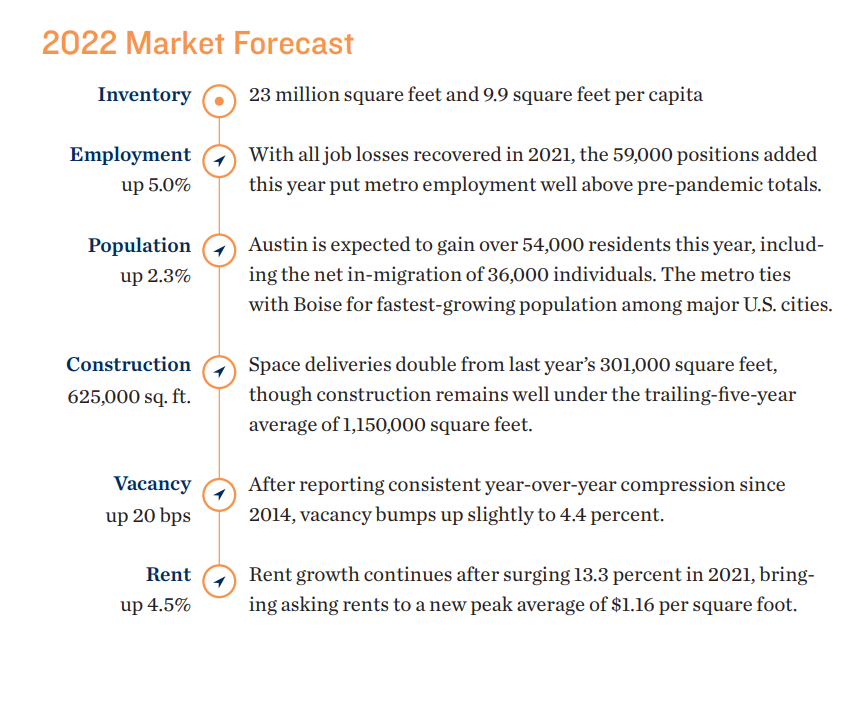

Booming Tech Sector Boosts Incomes, Storage Demand

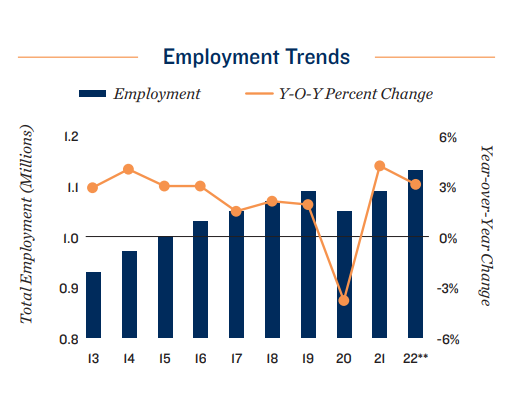

Economic Overview

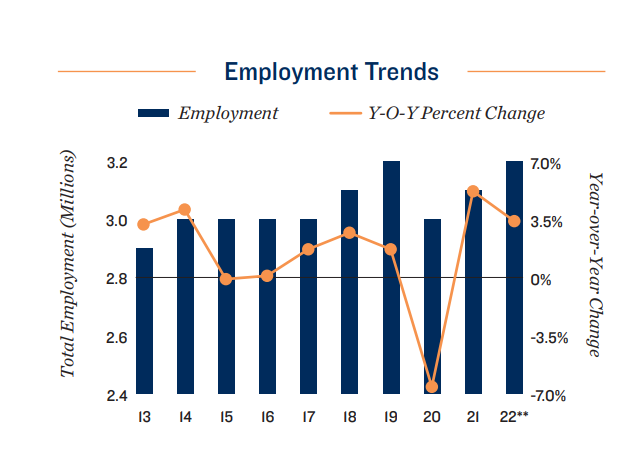

As prominent companies like Tesla and Facebook move operations to Austin this year, the metro’s job market is projected to grow substantially. Due to a thriving tech industry, Austin boasts the fastest job growth in office-using sectors among major metropolitan areas, allowing for a consumer base with higher discretionary incomes.

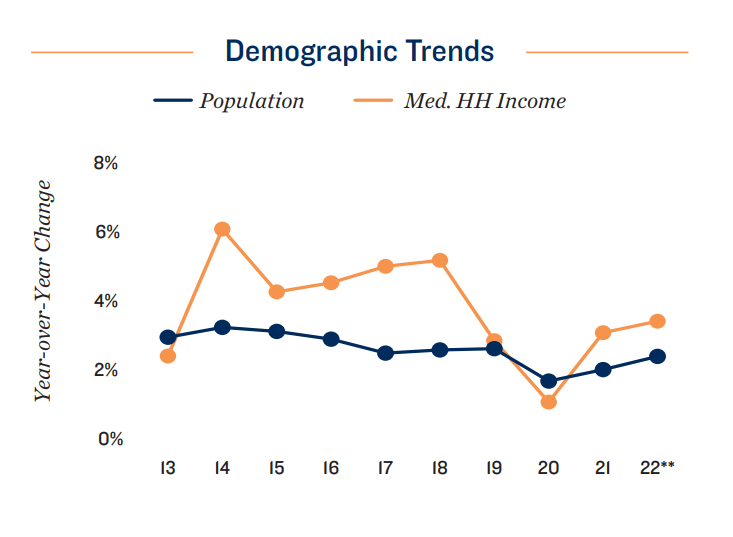

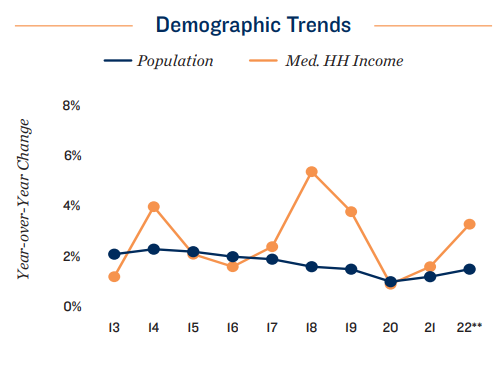

Demographic Overview

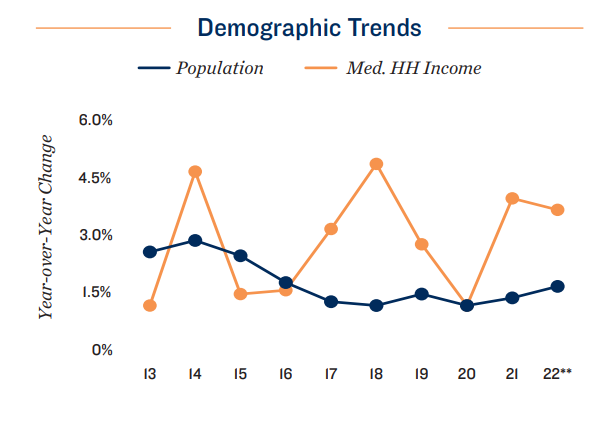

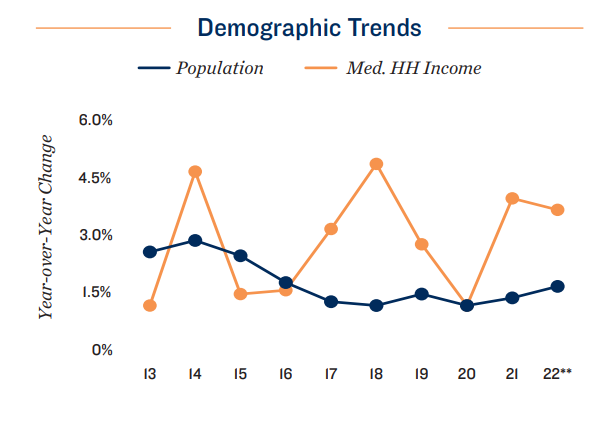

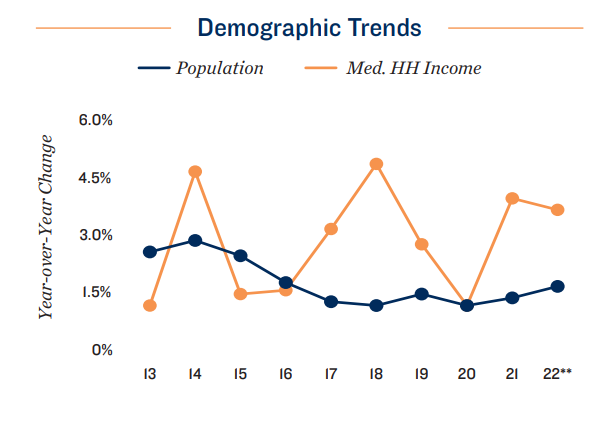

Having expanded by nearly 25 percent over the past decade, Austin has consistently ranked as the nation’s fastest-growing city, with a vibrant cultural scene and the presence of tech giants and startups alike attracting a plethora of young professionals. Austin’s 20-to-34-year-old demographic is set to expand by 23 times the national average in 2022, creating robust demand for storage as young renters navigate the local housing market.

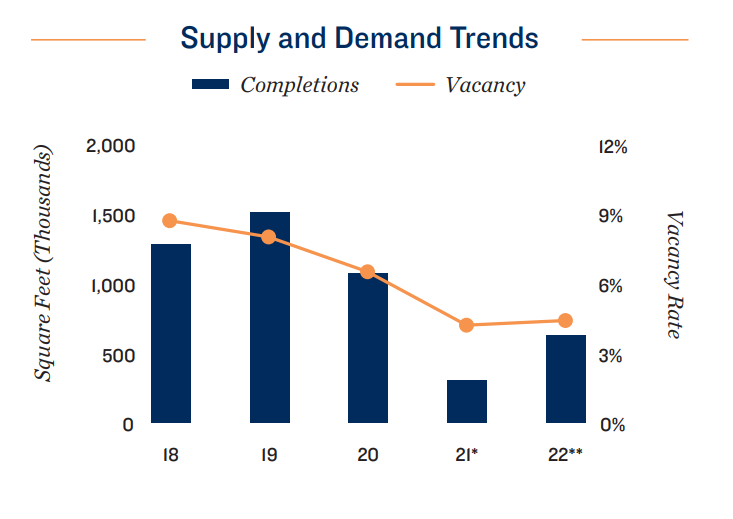

Construction Overview

Although Austin’s self-storage stock grew by over 1 million square feet each year from 2016 through 2020, the recent development pipeline has been more conservative. Combined, the 2021-2022 construction total will be under the trailing-five-year annual average for completions. This year’s new facilities are contained to the suburban I-35 Corridor, concentrated near both Round Rock and Georgetown.

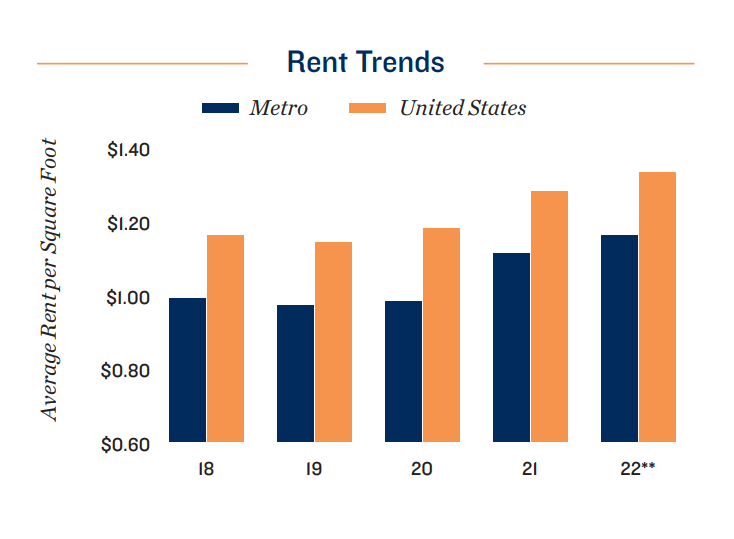

Vacancy/Rent Overview

Following several years of declining rents due to oversupply, the pandemic storage demand boom along with a restrained construction schedule reversed this course, sending rent growth into double-digit territory in 2021. While vacancy is projected to tick up for the first time in several years, rents are expected to increase at a sustainable 4.5 percent.

Workforce, Corporate Gains Boost Metroplex Economy

Economic Overview

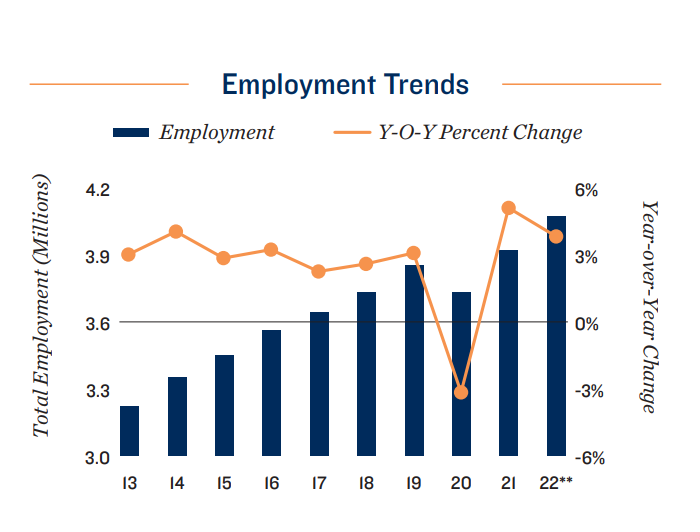

Already home to twenty-two Fortune 500 companies, the Dallas-Fort Worth Metroplex is a favorite target for corporate relocations, including a recently announced move by engineering giant AECOM. The favorable business climate has also allowed a swift job market recovery, with the metro’s employment total set to surpass 4 million workers this year.

Demographic Overview

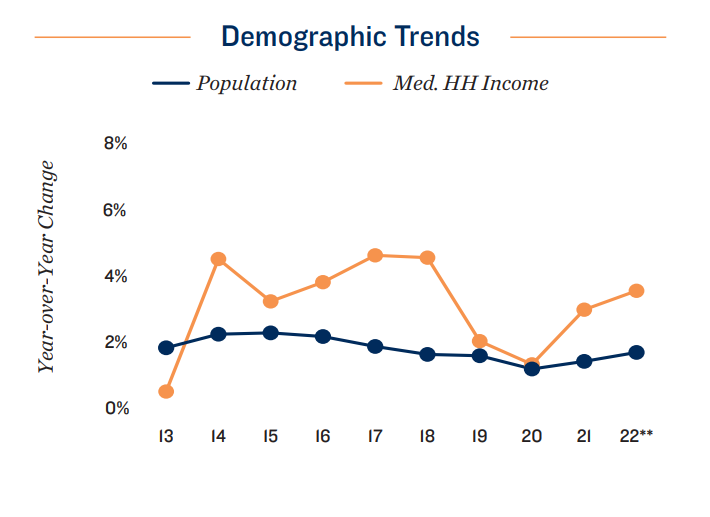

Solid economic performance has given way to consistently high in-migration to the market. A net-migration count of nearly 71,600 in 2022 brings the 10-year figure to over 730,000 individuals. The metro will also observe above-national average population growth across all demographics, including the 20-to 34-year-old and 65+ segments, which tend to be heavy storage users, due to their tendency toward downsized living spaces.

Construction Overview

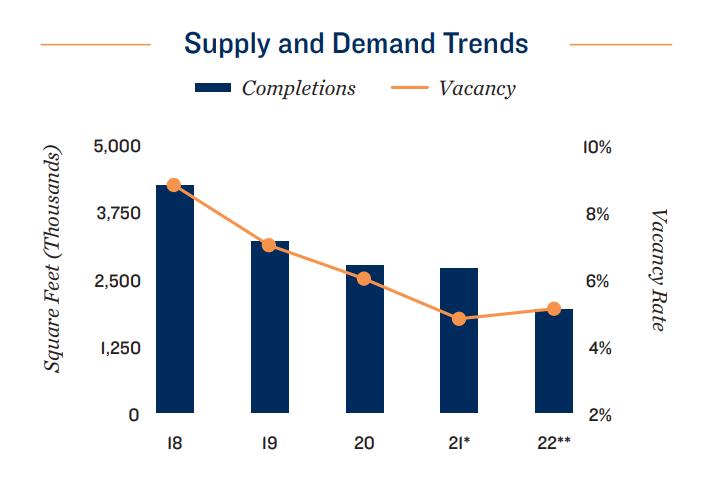

Development activity will be more conservative in 2022, as builders are set to finish under 2 million square feet for the first year since 2016. Northern Dallas will receive the most space, with 780,000 square feet marking a three-year high. The 530,000 square feet scheduled for Fort Worth is less than half the trailing five-year average.

Vacancy/Rent Overview

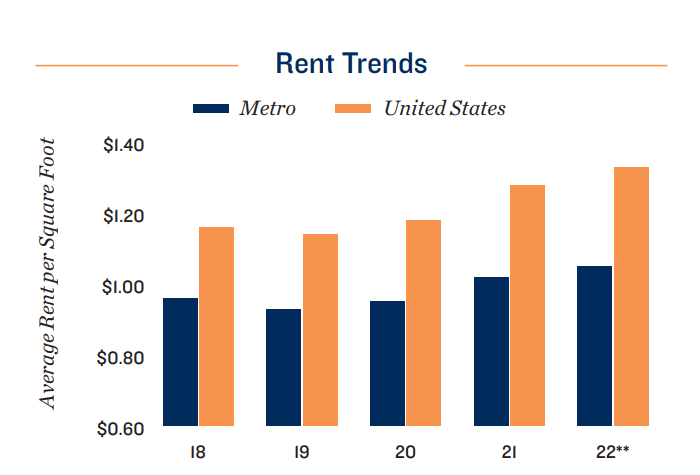

Prior to the health crisis, high annual supply additions kept availability above 8 percent, and the average rent fell nearly 20 cents per square foot from 2016 through 2020. Plunging vacancy from the pandemic demand boom brought rents back over $1 per square foot, though builders may risk oversupply if pipelines do not remain narrow.

Rents Stabilize as Construction Ebbs

Economic Overview

Unemployment in Houston decreased in 2021 after a jump in 2020, though the rate remained well above the national average. An increasing number of jobs available, however, positions Houston to possibly surpass pre-pandemic levels of the employment base this year. An additional 105,000 positions will come to the metro by the end of 2022.

Demographic Overview

An increasing number of jobs and downward trending unemployment lift household income by 3.6 percent in 2022, arriving at about $8,200 above the national average. New households are also on track to form this year, continuing a recovery and reaching the highest growth rate since 2016. Net in-migration will be at its highest since 2016 as well.

Construction Overview

Following a period of elevated construction, the number of completed square feet will decrease by 34 percent in 2022. Most openings will be located in West Houston, at 455,000 square feet accounting for 68 percent of this year’s new space.

Vacancy/Rent Overview

Vacancy will increase by 40 basis points to 5.4 percent in 2022; the rate, however, will remain below the average 8 percent seen in the past eight years. Lowering availability contributes to rent growth, allowing asking rents to continue advancing this year by 4.8 percent, stabilizing after a 10 percent growth spike in the advertised rent in 2021.

Cuts to Construction Puts Pressure on Rents

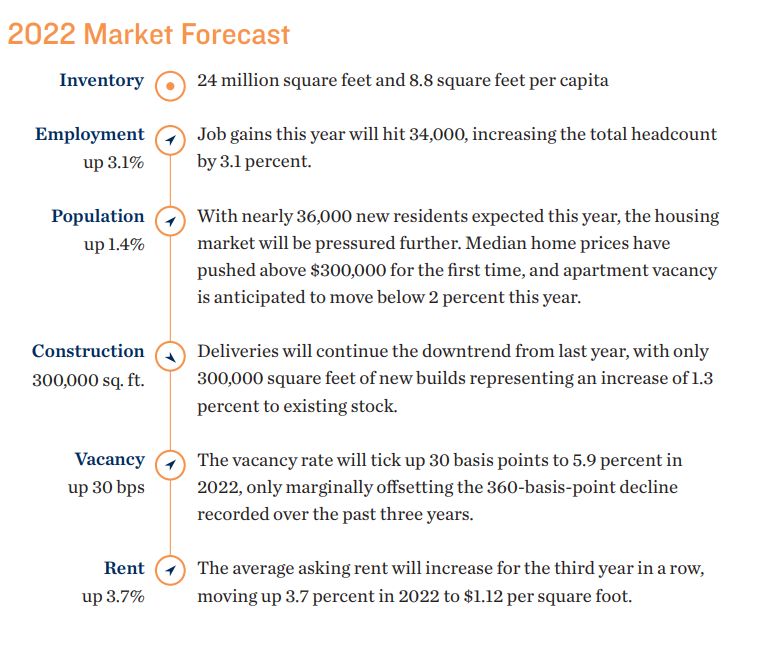

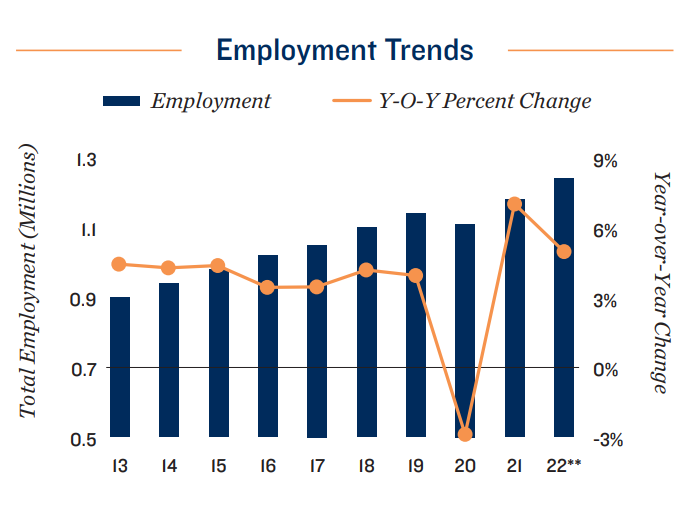

Economic Overview

Corporate relocations and expansions, including fast growing tech-focused firms, such as Skipcart and SafeRide Health, as well as more established businesses like Pabst Blue Ribbon, are helping boost worker counts. Total employment came within 1 percent of the pre-pandemic high at the end of 2021, a threshold that will easily be surpassed this year.

Demographic Overview

Domestic movers, many from higher-cost primary markets, have been a key driver of population gains. While this trend has aided growth for many years, the pandemic accelerated relocation decisions as work-from-home policies allowed employees to prioritize lower-cost areas with lower density and higher quality of life. The influx has boosted local retail spending, rising this year to more than 26 percent above the 2019 level.

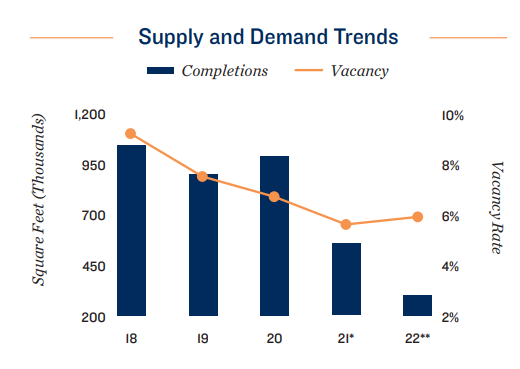

Construction Overview

Despite positive demographic demand drivers, new construction in 2021 fell to about half of the levels seen over the three years prior. Deliveries will dip again this year, with just 300,000 square feet expected to hit the market. Since 2001, average annual additions to stock totaled 580,000 square feet.

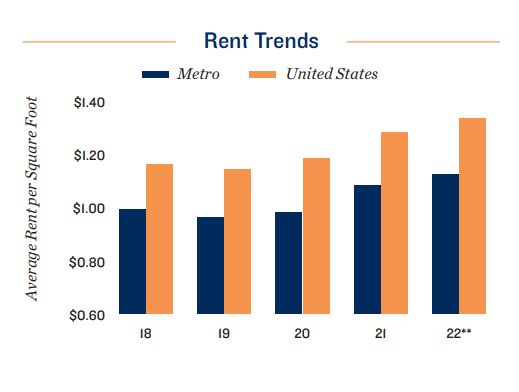

Vacancy/Rent Overview

With a slowdown in completions coinciding with positive demand trends, the vacancy rate has experienced a steady downward trajectory. Vacancy has nearly halved from 10.7 percent in 2014 to 5.6 percent at the end of 2021. The tighter market is lifting rental rates, with a sizable 10.2 percent gain registered last year.